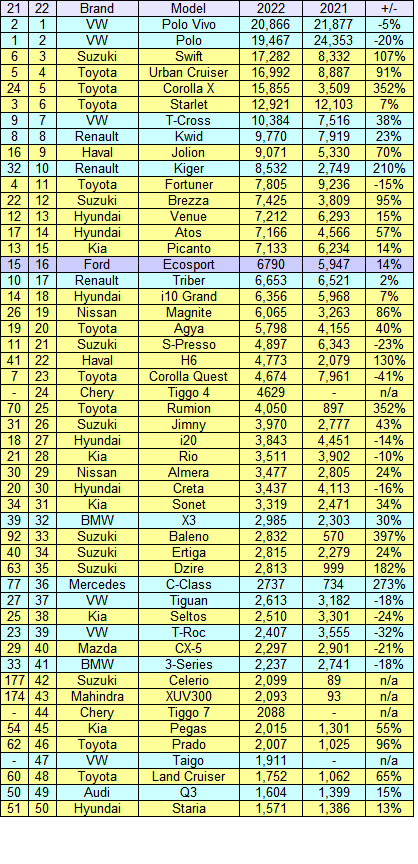

This is an updated list with models not listed before now shown. Data is somewhat haphazard as some brands are reluctant to share anything.

VW has the top two passenger car spots for two generations of the Polo model but had I added light commercial models then Toyota would be well in charge with the Hilux. The Ford Ranger too would be well up the list.

Suzuki is going well in the RSA and the Swift model has lifted to third. It has no fewer than eight models in the top 50. Toyota has nine so between them a third of the total below.

Chery has recently relaunched here but only reported sales for the second half of the year. However, as that's when the majority of the sales were made, the figure below for the Tiggo 4 and 7 models are not far off the real total.

Renault does well with cars not well known generally but sourced it seems from India. In fact, India would be a major supplier of cars here going by some of the models selling strongly. Of course, the RSA also has a car industry which is a success in its own right.