21 July 2022

Wales Sales: 2021

Scotland Sales: 2021

20 July 2022

Northern Ireland Sales: 2021

Lada Brand Model Sales : 2021-22 (Jan-Apr)

With domestic sales down 78% in April, it led to a -46% YTD so things aren't going well for Lada. Along with all the other problems in the industry, Lada has another with a war going on and the fallout from that. If that wasn't enough, owner Renault divested itself of the company.

The last report Renault released of sales data is below, from January to April. Mind you, data for the rest of the year wouldn't change much as Lada all but grinds to a halt for the time being at least. The loss of Reanult's expertise will hurt Lada unless a Chinese firm steps in to take over that role.

I coloured the chart to show which models increased their share of sales. It was the two 4wd models that lifted along with the utility Largus. (This will be the last of the Lada data).

Data source: Renault Group.

10 July 2022

Aston Martin Regional Sales : 2021

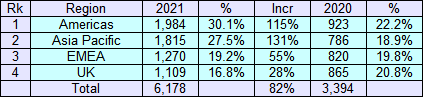

Aston Martin has been revitalised. From wholesale sales of 3,394 in 2020 to 6,178 in 2021. That's an 82% increase, with all regions playing their part. They are also the only manufacturer of cars in Wales as an aside.

Americas: It is the largest region for the brand, with sales close to 2,000. Volume was up 115% and that region currently represents 30% of the total.

Asia / Pacific: Close behind the Americas, this region mirrored the above in all facets.

EMEA: Europe, Middle East and Africa contributed almost 1,300 sales and close to 20% of the total.

UK: It is its own unique region and it only had a 28% increase.

I don't have a breakdown by model but assume the Welsh made DBX was a major contributor to the increase. There is now a 707 version, the first example pictured above getting plenty of TLC.

Aston Martin went through a tough patch but the business looks well and truly back on track. Talking of track, they are also into racing too but that's another subject.