It's been a while since Hong Kong has graced these blog pages. So let's see how things went in 2024.

First up, some background. HK doesn't limit car ownership like in Singapore with uses a certificate system that caps the number of cars on the road. Instead high registration taxes, parking fees and tolls are used to discourage both car ownership and their use. This is backed up with a quality public transportation system which offers an affordable alternative.

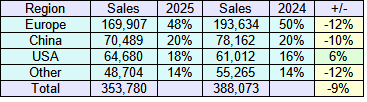

As for vehicle type, electric cars have become very popular. This has given Chinese brand sales real impetus as we can see below. Tesla is on top despite sales volume remaining the same. Holding a 20% share is impressive but with so many electric brands arriving, surely that is an untenable level of success.

Maxus has seemingly come out of nowhere and smart (picture above) came from years of obscurity to a top ten position with its new electric car range. Brands that sell fossil fuel cars will be increasingly marginalised.