We live in a world of change and increasing complexity. Some people seem to love delving into all of that while others find it tedious or confusing. Technology is designed to make life easier and more efficient but there is a point where advancement is lost because the complexity is reducing efficiency.

Take for example the touch screen in cars. The idea is simply using the tip of your index finger to achieve a desired result is more efficient than turning knobs and pushing buttons. I suppose it would be true if the modern car had fewer functions. This has resulted in the curse of the inefficient submenu.

If a car dashboard had both a touchscreen and all the physical controls as well, which would a motorist end up using? Flicking through a series of menus or activating a manual control? I know what I would be doing and I suggest most would be doing the same.

So what is driving all of this? I can't see a cost saving. Driver efficiency is reduced and safety is compromised. With eyes off the road while fiddling with a touch screen, the need for autonomous braking and lane departure warning is needed. Yet a human will always be better at evaluating and anticipating hazards than a computer will ever be. That is why autonomous cars have failed to materialise in any meaningful way years after they were promised.

The main driver for all of this is profit. Car manufacturers are eyeing making huge gains from selling features that can be downloaded. I can see that on occasion that would be useful but what I have noticed is that features that could have been loaded into the system at the beginning are not and then made available at a substantial extra cost.

I have always been someone who wants a car to get me from A to B and back again. I think optimum reliability was achieved a decade or two ago, which more likely fulfills the aforementioned objective. I don't want to eat and drink while driving or have phone conversations. I concentrate on driving so I don't need intrusive driver aids to protect me from any self induced distractions.

What most people want are essential features but few want superfluous ones. Indulgence that creates inefficiency and frustration is the accepted norm in the industry. Striking the balance between useful and unnecessary is beyond car makers today.

I have always loved cars but modern ones are causing me to lose that love. The simple joy of driving is being overtaken by technology. That's why the only car brand that would interest me today is Dacia. If I had to buy something else, I'd opt for public transport. I've never wanted a new car less than I do today.

I'll still love statistics and will still watch car sales but I can't say the way technology in cars is being used today is something I appreciate or find appealing. For me, it's all gone too far.

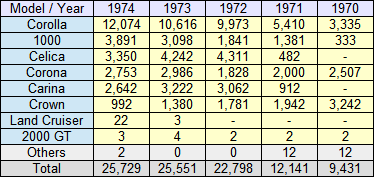

This is an area where sales statistics are not readily available so this is unique data below. Renault has fallen over the last few years but overall sales have also done so as well.

This is an area where sales statistics are not readily available so this is unique data below. Renault has fallen over the last few years but overall sales have also done so as well.