New Zealand has a myriad of car brands, some of which could only be described as bottom feeders. There are several marques with comprehensive dealer networks and the rest are in main centres only and selling in limited numbers. It's a tough market to crack unless you got in early or are now arriving with a budget priced product.

European brands that are not premium are the ones that are confined to larger cities so the fact another one is coming is a surprise. As the title says, it's Opel. They could have gone with Vauxhall which was a popular brand but too long ago for modern buyers to relate to.

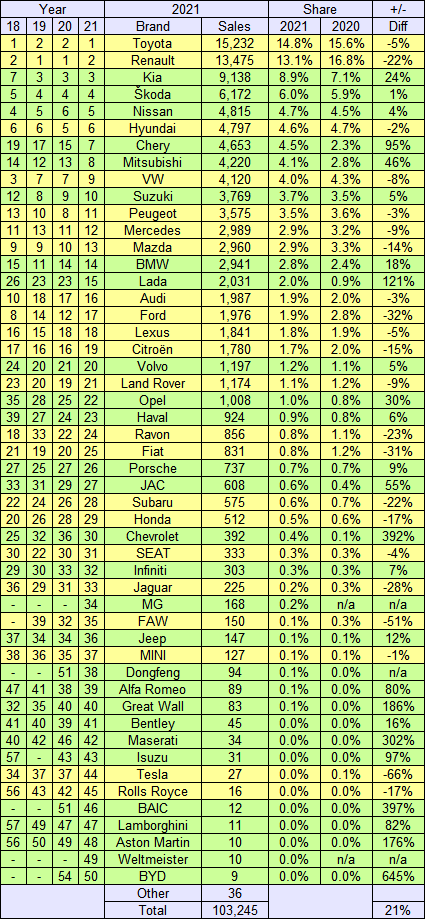

Opel was sold in NZ from the late 1980s until the early 90s. Just over 2,500 were sold which wasn't too bad but then it was absorbed into Holden. Now Stellantis owns Opel and have decided to give the market another crack. Electric will figure heavily but not entirely. Vans may join the ranks later too. A commencement date is yet to be released.

NZ seems to be a test run market in this region with for example Škoda, SEAT and Cupra all entered the NZ scene and then into Australia later. I assume a similar scenario may occur again if the brand's introduction into NZ works out. That may also depend on our cousins across the ditch being more encouraging of electric vehicles.