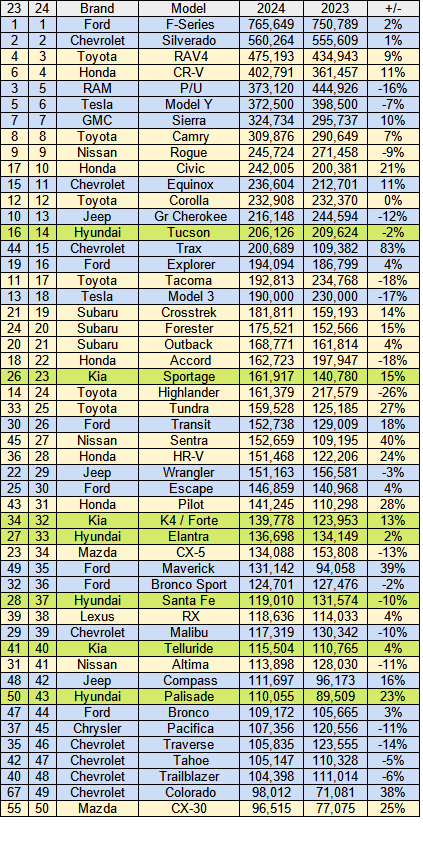

Toyota and Lexus are very popular in the US and it got better in 2024. Combined they sold over to 2.3 million. That's less than GM's 2.7 million but that puts it second for company sales.

So what's selling?

Toyota Brand: Sales are up 3% or 59,000 units. That's not substantial but the total is which shows just how well the brand is viewed in the US. It's the biggest selling nameplate.

The RAV4 is the most popular model with 24% of the total sales for the brand. That's no mean feat considering the large range offered by Toyota. It's also up 9% for the year.

The Camry is in a segment that many other brands have abandoned and it's enjoying success with less competition in a shrinking area of the market.

The Corolla kept an even keel while its jacked up namesake had a 31% increase to 93,000 sales.

The Tacoma pick up is down 18% while its bigger brother the Tundra is up 27% but when combined sales are down. Maybe they'll pick up next year.

The Mirai hydrogen fuel cell model had a quiet 2024 but its hard to read anything into that, seeing that it's a technology that's yet to take off.

I've combined the Highlander with the Grand Highlander, the latter closing in numerically on its smaller sibling as expected for the newer Grand model.

The Crown Signia SUV is supposed to be replacing the Venza but sales wouldn't give that impression so I've kept them apart.

Data & picture source: Toyota & Lexus. Photo above the Toyota Venza and below the Lexus TX.

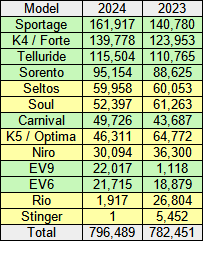

Lexus: Sales are up here too, but

only by

8%. That's over 25,000 more than 2023 so a good result. The US hasn't taken the LBX which is doing well elsewhere but small isn't what USA buyers go for so a fair call.

The most popular model, the RX is up 4%, but the new TX is already proving popular. The GX is down 3% but may have been affected by the arrival of the slightly smaller but not too dissimilar sized TX. The bargelike LX did similar numbers to last year.

Those ladies below look shifty.