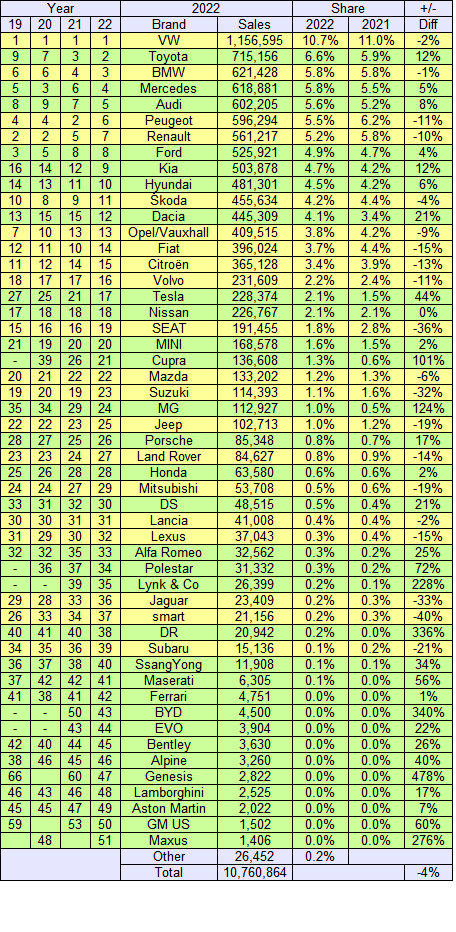

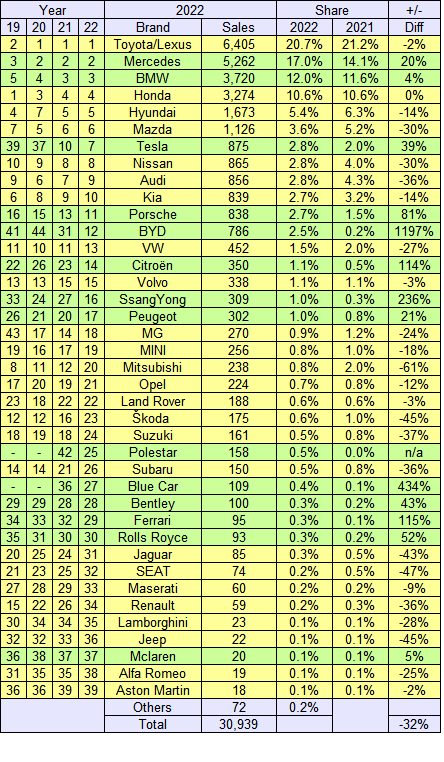

Registrations for December were up a promising 15% and for 2022 -4% so the deficit wasn't fully erased. The '+/- diff' column below is for market share change.. Green means market share gain but not necessarily an increase in sales.

VW is protecting its double digit share and still holds a clear lead over the competition. Toyota meanwhile is gradually improving its position with steady, incremental gains. VW will not want to relinquish top spot to its global rival in its own backyard.

Some of the smaller brands are doing well, green being a prominent colour further down the list. As new brands arrive due to a push for greener cars, unusual names are popping up, some not listed here due to their size. I'm surprised the supplier of this data didn't include BYD so I did some maths and came up with a reasonable estimate.

How Europe is defined and therefore how far to go collating sales statistics will vary by source. I've also noticed when the following year's sales are presented, the previous year's numbers are modified with improved data used to refine the figures. So some of the 2022 numbers will be updated at the end of 2023. At least we have a good idea of how things are. Those who put the numbers together are to be commended as it can't be easy with some sources in particular.

Data source: ANE.