They say the devil is in the detail. The fact that imported models do not feature here can affect how some brands are portrayed. In some cases, smaller foreign brands don't appear at all as they import all their cars. In other instances, a marque imports a reasonable number of vehicles while assembling others, in which case the figure here will be far too low.

Then I read some cars that are made in China and exported are included in the sales statistics below. If that's the case, the data is somewhat compromised, depending on the scale. Data should not be manipulated to enhance the performance of a local manufacturing operation at the expense of objective information. That is so odd, I find it hard to believe.

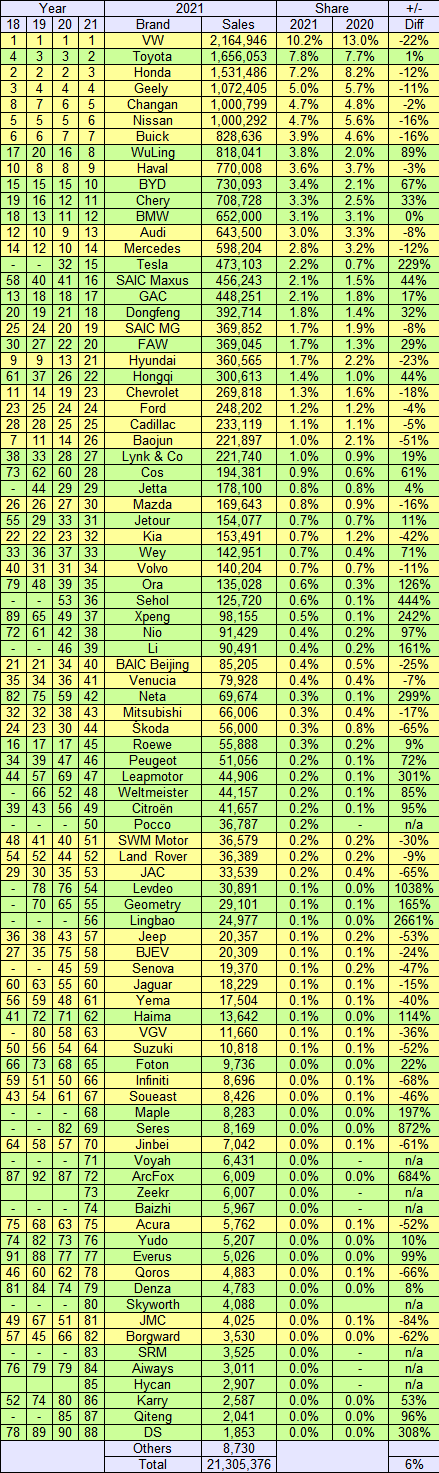

The market was +6%, the '+/-' column below is comparing market share variance for 2021 with 2020. So which brands were able to improve their share? The colour shadings show which way the wind is blowing. It still has a look of the wild west about it.

VW is well ahead fell by some way this year in share. Toyota is steadily making its way up the list and Wuling is mounting a revival. Tesla has arrived and moved quickly got into its stride. I wonder how that will go down with local officials? Cos has moved from obscurity in 2020 very quickly. 'Cause it's owned by Changan so one would think that's helped the brand get such an upswing in sales.

It would be great if all registrations were included. I also wonder when it will be decided that the industry is robust enough to face imports without tariff protection. Of course, it already is so it's hard to imagine that this situation will ever change.

Data source: CAAM.

|

| In case you don't recognise it, it's a Changan Raeton CC |

No comments:

Post a Comment