28 June 2022

Hyundai India Model Sales : 2015-2018

26 June 2022

Hyundai India Model Sales : 2010-2014

Hyundai started selling cars here in 1998 so got in relatively early. They almost immediately went past the 10% mark of total sales and reached 16% by 2009. So how did they go from there?

2011: 2010 started a slight slide despite the Eon mini 5-door hatchback (right) arriving in '11 and soon selling well. It seemed to take sales from the i10.

2012/13: The Elantra's turning up did little, being the small selling model it became. A new model i10 in 2013 helped in pushing market share back up again after declining.

2014: The Xcent (left) arrived, which was an i10 with a boot which to be consistent I should have combined. The numbers were high for both of them high so I decided not to. Regardless, the Xcent's arrival lifted penetration and took Hyundai to a market share all time high in 2014. Roll on 2015.

25 June 2022

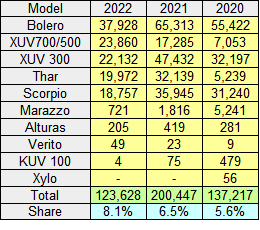

Mahindra India Model Sales : 2020-2022

While car sales data from India always has that slight uncertainty about it, it's a bit more with Mahindra, perhaps because their diverse range can be tabulated in differing ways. For whatever reason, the historical data for Mahindra is too uncertain to be used. Therefore, we take it up from 2020.

The XUV700 medium sized SUV (picture above) replaced the 500 but otherwise it was business as usual. What was noticeable was the increase in share, from 5.6 to 8.1% so far in 2022. The XUV700 is leading the charge but generally the big guns are firing. The biggest selling model is the Bolero large SUV (picture below), surprisingly popular in a country where small vehicles dominate.

24 June 2022

Toyota India Model Sales : 2009-2013

We have seen from previous posts about the Indian car market that it's a difficult market to exist in despite many who entered that it was going to be some sort of El Dorado. Few, if any, have found it so. But surely Toyota would make a big splash here, it's the strongest brand in Asia by far. Let's see.

Toyota hit the ground in 2000 and within four to five years was around the 4.5% mark which was a very positive result. It did start to slip back from there and by 2009, help just 3% share. What could be done to arrest the slide?

The Innova medium MPV (picture at top) came in circa 2005 and was the main selling model. It received modest support from the Corolla, which debuted around 2004. However, this was Toyota Lite and more was needed to bolster the range. That was soon addressed as we shall now see.2011: The Fortuner medium-large SUV (just above) was the start of the brand's hoped for renaissance. Mind you, that's too big to have the impact Toyota needed.

2012: The Etios compact 4-door car and 5-door hatchback (Liva) was more what was needed to get the volume to a more respectable level and it complimented the extremely popular Innova nicely. Between then, they were the main reason the brand passed the 6% mark.

23 June 2022

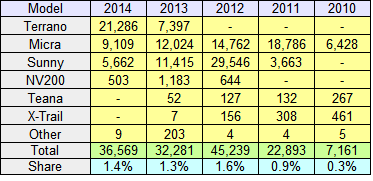

Nissan India Model Sales : 2009-2013

Nissan decided to enter the Indian car market and in 2010, it arrived in earnest. The Micra mini hatchback was initially the main focus and that was soon backed up by the Sunny saloon car. Then came the Terrano (left), a Renault Duster SUV being the donor car. It looked like a balanced range of vehicles but the 2012 peak of 1.6% of the market wasn't improved or even maintained. The NV200 Evalia MPV (right) was introduced in 2012 but didn't stay for long.

Nissan decided to enter the Indian car market and in 2010, it arrived in earnest. The Micra mini hatchback was initially the main focus and that was soon backed up by the Sunny saloon car. Then came the Terrano (left), a Renault Duster SUV being the donor car. It looked like a balanced range of vehicles but the 2012 peak of 1.6% of the market wasn't improved or even maintained. The NV200 Evalia MPV (right) was introduced in 2012 but didn't stay for long. Honda India Model Sales : 2014-2018

22 June 2022

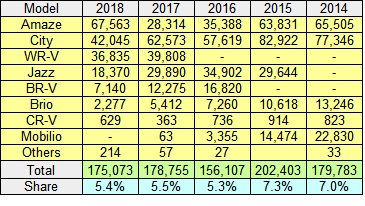

Honda India Model Sales : 2009-2013

Honda started manufacturing cars here in 1997 so the brand is fairly well established here. In 2004 it hit its straps and reached 3.4% share after taking time to establish itself. Percentage penetration reached a new high of 4.3% in 2006 when the Civic was introduced. It drifted back to 3.4% in 2009.

2009: The Jazz hit the market in this year but not with a huge splash. The heavy hitting was being done by the compact City model (picture left), all the others featured in relatively minor supporting roles.

2012: This was a big year when the Jazz and Civic models were retired and the Brio took off. The Brio was a compact 5-door hatchback that slotted below the Jazz in size.

2013: The subcompact Amaze 4-door saloon car arrived (picture on right) which was under the 4 metre (157.5 in) length which puts it in a lower duty bracket. It slotted under the City saloon car. The brand was back to 4.3% share, equalling its record back in 2006.

21 June 2022

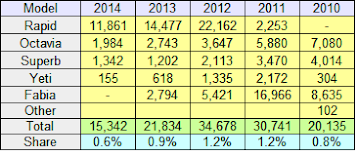

Škoda India Model Sales : 2010-2014

18 June 2022

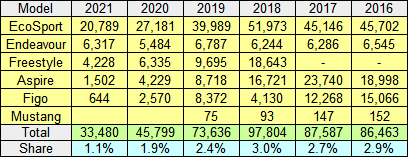

Ford India Model Sales : 2016-21

Ford was doing what so many other manufacturers have been doing, trying to make a business case for manufacturing and selling in India. Hovering just below the 3% mark wasn't good enough but little was changing despite little in the way of new models.

2018: One newby was the Freestyle (picture above), a crossover variant of the Figo. I would assume it was a cost effective model and sales were OK for the year but not the next.

2021: It's operation ran up losses in excess of $2 billion dollars in the previous decade! Ford has therefore decided to end sales in the country but for now still exports. There is worker unrest over Ford's decision to end production by the end of 2022. It it still has two plants there, one of these will probably be sold to Tata, which will make the exit slightly more palatable.

17 June 2022

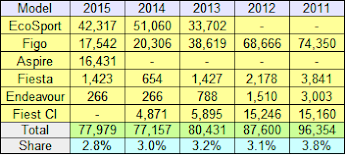

Ford India Model Sales : 2011-15

In recent times, Ford started selling cars in India in 1997. From there it rarely reached even a 2% share. Could they ever make a real go of penetrating this market? Let's have a look.

Market share jumped from 1.6% in 2010 to 3.5% in 2011 with the arrival of the compact Figo hatchback. It looked similar to but was small than the Fiesta Classic that was sold alongside it. A good start.

2011: Now sales were close to 4% of the total although so many eggs in the Figo basket wasn't ideal. 2012 held up pretty well with nothing new released.

2015: The Fiesta Classic finished its run in 2015 and a new generation Figo was released, the Aspire being the 4-door version. It was based on the Ka but sales show it didn't go that well. A new model should lift volume. Things weren't looking so rosy for Ford in India. Would they continue or leave?

16 June 2022

Chevrolet India Model Sales : 2011-17

GM has been a part of the Indian car scene for many years. In 2003, Chevrolet became the brand the company used. From 2004 the Optra and Tavera (right) were assembled. The Aveo (2006), Spark (2007 - pic below), Captiva (2008) and Cruze models (2009) quickly followed.

GM has been a part of the Indian car scene for many years. In 2003, Chevrolet became the brand the company used. From 2004 the Optra and Tavera (right) were assembled. The Aveo (2006), Spark (2007 - pic below), Captiva (2008) and Cruze models (2009) quickly followed. 2011: With this range of models, GM reached a respectable 4.4% share of the market, slightly down on a strong 2010. The Sail arrived this year but was too late to make an impact. The Optra (Lacetti) ended its run. 111,000 units were sold.

2012: The Aveo said its goodbyes but market share fell and a new model was needed. 93,000 registrations were achieved.

2013: The slow selling Captiva was discontinued, but a hatch variant was added to the Sail and the Enjoy medium MPV was added to the range. Despite that, it had little effect on market share. Sales were down to 87,000.

2014: Sales fell further (%5,500) with no new models to spur things along and existing ones in decline.

13 June 2022

VW Brand India Model Sales : 2015-18

12 June 2022

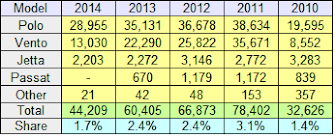

VW Brand India Model Sales : 2010-14

The VW brand was a relatively late entry into the Indian market but obviously felt the potential here was too great to ignore. Škoda had been there since about 2003 and VW was introduced in 2007. Sales went from 200, 1,600 and 3,000 up until 2010 when we take up the story.

2010: The Polo hatch and Vento (picture above) saloon models started to be assembled and they had an immediate impact with sales up tenfold in just a year. I called them models but they are technically just one with the Vento being a Polo with a boot.

The Jetta is a medium sized car that was also assembled locally but its size meant it was always going to be a slow selling car. The same could be said for the Passat.

That's how it stayed for the next few years as market share hit 3.1% in 2011 but then declined to 1.7% in 2014. Was VW already resigned to being at best a marginal player in India? The next installment will reveal more. (Hint, click here).

09 June 2022

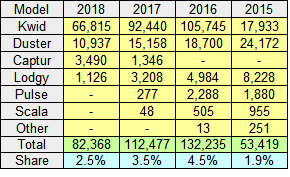

Renault India Model Sales : 2015-18

Market share had dropped during 2014 to 1.8% , but was that simply a blip on the radar? Well. 2015 was a slight improvement but 2016 was a huge lift to 4.5%. What was the catalyst for the upward spike?

2015: The arrival of the Kwid model (top picture) and to a much lesser extent the Lodgy (left). The Kwid is a small crossover hatchback that not only earned Renault a few rupees (no, not quid) but also serious volume. Over 100,000 found owners in 2016. It hit the target.

The Lodgy, a medium sized MPV also chimed in with some useful sales in 2015 but surprisingly was unable to sustain that.

2017: The Duster was still doing OK but any hope of the Captur (right) capturing a reasonable following didn't materialise. A few other models were discontinued at this point too.

2018: This left four models and overall share going backwards again. Was there another model that would be introduced to arrest the slide?

For the 2019-22 period, simply click here. 2010-14 just click here.

03 June 2022

Renault India Model Sales : 2011-14

Cracking the Indian market is no easy feat, with Suzuki having such a tight grip. With very steep import duty, importing is out of the question so local assembly is the only option. For that reason, most manufacturers are not represented here.

For Renault-Nissan the solution was to build a factory that could be shared, saving on costs. A plant was set up in Chennai. Reanult, Nissan and Datsun* cars have been made there. Let's see how the Renault model range developed.

2011: The beginning.

Fluence: A smallish saloon car that wasn't the type of car that is popular in the country. It was a start got things up and running until more suitable cars came on stream. It came to the end of its life in India by 2014.

Koleos: This medium sized SUV was in much the same category as the Fluence in not being the ideal fit for what was needed. sales certainly reflected that and it too came to a n end in 2014.

2012: Things took off with three new models.

Duster: The compact SUV that was popular elsewhere was likewise successful here. Sales reached 50,000 in 2013 before falling back to 40,000 a year later. It was what Renault needed to really kickstart its move into India.

Pulse: This was a Nissan Micra rebadged for Renault. It had reason to succeed but after reaching 6,000 sales in 2012 fell away sharply with barely a pulse. It ended its disappointing time here in 2017. At least using a Nissan model saved the set up costs associated with a completely new model.

Scala: Like the Pulse, it too took advantage of a Nissan model, the donor car in this instance the Sunny. It was positioned slightly upmarket from its sibling but 2013 sales just short of 7,000 was the best it could muster. It soon went the way of the dodo, in 2016.

Summary: Renault quickly climbed to 2.6% of the total market by 2013 but stalled and its share fell back to 1.8%. Was this a temporary glitch or a harbinger of declining fortunes ahead? The next article can be found by clicking here.

*For coverage of Datsun India, simply click here.