At the beginning of the 1970's, the UK was exporting 36% more passenger cars than it was importing. To put that into time context, the UK joined the EU in 1973. By 1977 it was neutral and thereafter it has been in the minus region.

31 March 2023

UK Plus / Minus Percentage : Import / Export

Land Rover Discovery Top Nations : 2022

The current Discovery is a top draw product that doesn't sell in the numbers it deserves to. The UK is the primary market with 30% of sales. In some European countries like Ireland, it is very popular as a commercial vehicle with just two seats (see picture below).

What may put off some buyers is it is so good off road that there has to be some compromise when on tarmac. It has a breadth of talent that go beyond what most users need, in some respects an overkill. The sort of thing I don't need but somewhere in my subconscious I'd like to own. Not to satisfy a materialistic craving but a fascination with what it can do.

The data below is from various sources, not from JLR and sources can vary. One or two top nations may be missing.

Range Rover Velar Top Nations : 2022

Rolls Royce Global Sales : 2022

Rolls Royce passed 4,000 deliveries for the first time in 2014 and I thought that was probably as high as it would get. For a few years, it seemed so then a sudden upturn and 5,000 was reached in 2019. That was because of the Cullinan SUV and I hadn't allowed for such a model when making my prediction.

The Cullinan has passed the 50% mark for the company and this sort of vehicle is an essential part of any car maker's range...except Mclaren and I'm thinking they will come around eventually. It would be ultimately suicidal not to.

Looking at the picture above, they certainly have quite a presence. The problem is it's too long for my garage. Shame about that. But as the old saying goes, if it doesn't fit in the garage then you can't afford one.

Data source: BMW Group.

30 March 2023

BMW MINI Global Sales : 2022

293,000 MINI cars were sold for the year, similar to 2021. The Hatch is just over the half way mark, the Countryman makes up a quarter with the other two around 10%. The Clubman would be my pick (picture below).

Data source: BMW Group.

29,500 cars found homes in the USA, 37,000 if one adds Canada and Mexico. That's well down on historical peaks so North America isn't as important for the brand. About 170,000 were sold in Europe so that is where most go and sales have been more consistent there. Australia and NZ combined were 3,850 sales if trivia is your thing. I don't know for China as BMW doesn't break down MINI sales by region as far as I know.

Land Rover Discovery Sport Top Nations : 2022

A long time big selling model for the company but last year was by far the poorest since its inception. With the issues around the industry, it's hard to draw conclusions from that but 2023 will tell us more with semiconductors more readily available. I's the most likely Land Rover I'd own.

The Chinese assembler of the Discovery Sport were able to keep the numbers ticking over and as a result over 42% of all Disco Sports sold were in China. They are also assembled in Brazil so that helped there.The USA was some way ahead of the UK although US numbers by model are hard to come by so I trust the source is kosher.

The data below is from various sources, not from JLR and sources can vary. One or two top nations may be missing.

BMW Group : 2022

BMW used to produce some decent data for its car division but it's now too limited to bother publishing here. It still does some useful info so here it is. It's for BMW, MINI and Rolls Royce.

Regional sales: After an 8% gain in 2021, a drop of 5% was recorded in 2022. Not a bad result all things considered (profit was good too). All regions were down but none by much.

Assembly plants: 33% of BMW production was in Germany, up slightly. China was steady at 28% as was the USA (17.5%). Both contract plants contracted and the Partner Plants withered even more so.

29 March 2023

Jaguar i-Pace Top Nations : 2022

Jaguar was quick to get the i-Pace out before its Euro competitors but after a year or two seemed to let it meander along. Maybe someone did the maths and decided it wasn't earning its keep. The execution of the i-Pace was excellent in many ways but off the pace in a few others. It was ideal for some but not for everyone.

I was surprised to see that the UK has become such an important market for it. 65% of 2022 sales! Jaguar will go all electric by 2025 so the i-Pace will have been an excellent vehicle to prepare Jaguar for that. However, the gap between this car and the next electric one (when it arrives) is too long. At least Jaguar has got a focus on where it is heading.

The data below is from various sources, not from JLR and sources can vary. One or two top nations may be missing.

VW LCV Global Model Production : 2022

It was a case of steady as you go for the light commercial wing of the VW Group. Profit was strong as well and with a cost saving tie up with Ford in this area surely it can only improve further. The Caddy and Crafter led the way but a new Amarok will be a useful addition to the division. VW took the small Saveiro pickup out of LCVs but I keep them in there.

Data source: VW Group.

28 March 2023

Range Rover Top Nations : 2022

The Range Rover has come a long way from its beginning in 1970. It was a workhorse back then and it wasn't that popular initially. As it evolved into a posh, high riding luxury car and people's affluence grew it has certainly earned its keep.

Others have followed it but not with the same offroad capabilities, which give it a uniqueness that appeals to many. It's nice to know it is so capable offroad even if that is never realised.

The USA is a strong market for the car, with 30% of total sales. The UK is less than half of that and Germany less that a quarter of the UK. China is conspicuous by its absence as also a few other places as the 'Other' 50% would indicate. It was interesting to see Korea make the list.

The data below is from various sources, not from JLR and sources can vary. One or two top nations may be missing.

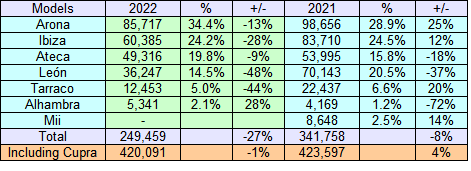

SEAT/Cupra Global Model Production : 2022

SEAT has been the problem child for the VW Group for many years but it seems to have found a way to sort it out. That is in the form of the new sporty subbrand Cupra. While SEAT went down 27% in production numbers, Cupra was up over 100% which brought the combined total to about even. For now profit is minimal but surely Cupra will help in that department in the future.

Data source: VW Group.

Cupra is based around the Formentor SUV and now the Born electric hatchback (picture above). In countries where SEAT is not a well established brand, Cupra is outperforming its older sibling.

Regional sales: VW combines regional sales with both marques but I assume they don't vary that much by region anyway. Europe is the place where things happen for the company. The Asia Pacific region is an undeveloped area and an attempt to penetrate there is now underway.

27 March 2023

Range Rover Velar Top Nations : 2022

I view the Velar as the softer model in the Land Rover range. Not rugged although capable of being such. Suave and sophisticated, it offers cosseting classiness in a very attractive package. That's how I see it anyway.

Nearly 28,000 were sold globally. It certainly hit a sweet spot in the US where nearly a third of Velars found homes in 2022, the UK is half of that. Still, between those two countries 47% of all sales were made. I'd like to know ho many were sold in China but that isn't for public consumption.

The data below is from various sources, not from JLR and sources can vary. One or two top nations may be missing.

Jaguar F-Type Top Nations : 2022

Jaguar has a long history in sports back, going back to shortly after the end of WWII. It has made beautiful sports cars and the F-Type is no different. It was considered the successor to the E-Type despite the time gap and it was a worthy successor too.

The curtain will fall on the F-Type in 2024 with no replacement in sight and I'm thinking there won't be one. To me, a beautiful car to behold and the automotive world will be that little bit poorer for its demise. I wonder if there will be some sort of mini sales rush. I'd say don't leave it too late if you're thinking of procuring one of the last of these fine sports cars.

The USA is the main market for them with one in three sales being there in 2022. The UK took one in five and Germany one in seven.

The data below is from various sources, not from JLR and sources can vary. One or two top nations may be missing.

Porsche Global Model Production : 2022

In a year that most found challenging, Porsche prospered. The two SUVs both reached or exceeded a 30% increase in production. Combined, they passed the 60% mark. Profit was up too so that wasn't sacrificed in the pursuit of growth.

Data source: VW Group.

26 March 2023

Jaguar XE Top Nations : 2022

2022 was a tough year for JLR as they seemed to struggle more than most to get a supply of semiconductors. Logic would dictate that JLR would allocate supply to the models that made the most money and if so the XE, along with Jaguar generally, became the sacrificial lamb.

The XE is still a good car, evidenced by its ongoing success in the competitive Chinese car market. Over 90% of XE sales were there, with the local joint venture partner Chery having success while the rest of the world was starved of product. I was surprised that Germany took more vehicles than Jaguar's home market.

With no new products anytime soon and a production ready XJ in my opinion bizarrely ditched, Jaguar will have to continue with the XE and XF until electric models arrive. The brand is to be fully electric by 2025 and positioned more upmarket.

The data below is from various sources, not from JLR.

Skoda Global Model Production : 2022

2022 was the fourth consecutive year where production volume has fallen. Before that, it was increase upon increase. So what has happened? Škoda has remained profitable - although down slightly. Is it a case of consolidating what it has achieved and looking more at keeping up with change? Some next generation models are arriving in late 2023 and a new, smaller electric car is on the way.

SUVs while increasing still only account for 38% of the total and they generally have better margins than cars. The Scala/Rapid and Octavia lead the way. Electric models are needed in a continent where that is the future. The foundation is solid, so keeping up with change is the task at hand.

Data source: VW Group.

25 March 2023

Audi Global Model Production : 2022

Audi production reached nearly 1.7 million cars for the year, up 7%. It's still short of the 2016 peak of 1.9 million but this is a more profitable Audi than back then. The Q5 is by far the strongest model, production up 80,000 units over the Q3. The five biggest models account for 72% of the total number produced.

Data source: VW group.